No one wants to talk about their finances – we just all hope everything will just work out. Unless you can afford your own financial advisor, the job of fixing your finances falls on you. I want everyone to feel comfortable and understand how he or she can help himself or herself almost on autopilot.

[highlight color=”pink”] FIRST [/highlight] To attack any situation you must know where you stand. A free copy of your credit report is available to you every year from annualcreditreport.com and will allow you to see what credit has been taken out in your name. Armed with this information you can look and make sure that all the loans and credit cards taken out are all truly yours or if there are an inaccuracies. On the last page of the report are the numbers to contact the three credit reporting agencies and report any incorrect information.

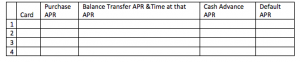

[highlight color=”pink”] SECOND [/highlight] Call, go online, or check your credit card statements to see what APR (Annual Percentage Rate) you are paying. It is important to note that there are typically three APRs the purchase APR, the balance transfer APR, the cash advance APR and in very small print the default APR.

The purchase APR is just like it sounds any time you use your credit card to make a purchase at Bloomingdales, the groceries store, or gas station it falls under this category. The balance transfer APR is the percentage rate you pay on amounts transferred from another one of your credit cards to that one. When you go to an ATM or have an amount of cash transferred to your bank account this is subject to the cash advance APR. Knowing this information you can pay down the highest rate balances first, or transfer balances from one card to another allowing you to pay down your balances faster.

[highlight color=”pink”] THIRD [/highlight] Call your credit card company and ask if they can lower your APRs, you will be surprised how many times they will! Also ask how you can put your credit card on auto pay. Put all your credit cards on auto pay for the minimum payment so you will never miss a payment again. If you cannot afford to make all your minimums in the same paycheck many companies will amend your due date so you can pay mid-month.

Once armed with all this information you should see what balances you can transfer to take advantage of the 0% or lowest APR and if there is a fee for transferring. Make sure you do not go above your limit you should leave a cushion of at least 10% and make sure any first month’s fees will not put you over limit, as well. Keep in mind you should pay your highest interest rates first.